Smart Spending: A College Student’s Guide to Breaking the Impulse Habit

College brings freedom and countless opportunities to spend money you may not have, and mastering impulse control is crucial for financial success. In a 2023 online study performed by Qualtrics on behalf of Credit Karma, reported that 58% of Gen Z identified as emotional spenders.

Why impulse spending matters

While one-third of Gen Zers say social media influences their purchasing decisions, only 23% of Americans aged 18–24 have more than $100 in savings. Impulse spending, especially when driven by FOMO, tempting sales, or even stress, can quickly interfere with your financial goals. But the good news? You can break the cycle.

Three proven strategies

- Make Your Goals Visible: People who visualize financial goals are nearly twice as confident about achieving them. Boost your motivation by keeping your goals more visible. Consider adding your goals to your smartphone's lock screen, placing sticky notes on your mirror, or setting daily reminders to stay on track.

- Use the 24-Hour Rule: Wait a full day before committing to buying any non-essential purchases. This works because most shopping dopamine hits occur during anticipation, not the actual purchase, and sleep improves decision-making abilities.

- Find an Accountability Buddy: Choose a trusted buddy or family member to contact when you feel the urge to spend. We’re often better at giving advice to others than following it ourselves, making external accountability crucial for success.

Building your financial foundation

Start small with a $1,000 emergency fund, which could help cover unexpected expenses. Using budgeting apps or printing out our free budgeting worksheet could help you visualize the progress of your budgeting goals.

Quick knowledge check

Key takeaway

One of the most important financial goals for college students is building an emergency fund, a goal that can be achieved by budgeting. Breaking impulse spending habits requires making goals visible, implementing waiting periods, and building accountability systems.

Reach your savings goal faster

Consider opening a StairCASE account to help build your emergency fund. Start with just $50 and earn a competitive rate of 5.25% APY (10x the national average). Plus, enjoy the flexibility of adding money whenever you want!

In this issue of Rising Wealth, Rising Stars, we’re tackling credit scores—what they are, why they matter, and how to boost yours.

Ready for a fun challenge? Let's test your knowledge with this quick trivia question.

What is an emergency fund?

A) Money set aside for vacations

B) Money set aside to cover unexpected expenses

C) A savings account for buying a car

D) Extra cash for shopping

Scroll to the bottom of this blog for the answer!

Understanding Your Credit Score: A Guide for College Students

As a college student, you might not think much about your credit score, but it plays a huge role in your financial future. Your credit score can determine whether you get approved for a car loan, an apartment, or even a credit card. Understanding how it works now can save you trouble later.

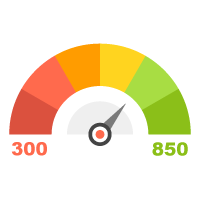

What is a Credit Score?A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. The most common credit scoring model is the FICO Score, which ranges from 300 to 850. The higher your score, the better your chances of getting approved for loans and securing lower interest rates.

|

|

|

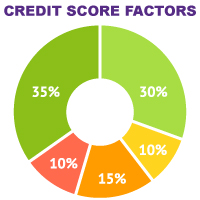

What Factors Affect Your Credit Score?Your credit score is determined by several key factors:

|

Why Does Your Credit Score Matter?Your credit score can impact your life in big ways. Let's break this down: Let’s say you're looking to buy a new car, and choose to finance it. If your credit score is on the higher side, 720, for example, you may qualify for a low-interest auto loan, saving you thousands of dollars over time. But if your score is on the lower end, 550, for example, you might get denied or stuck with a high-interest loan, making the car much more expensive.

|

|

|

|

How to Build Credit as a College StudentIf you’re just starting out, here are some easy ways to build your credit:

Pro Tip: Your credit score matters as much as your GPA. Start building it with the Student VISA Credit Card from CASE Credit Union, perfect for beginners. Plus, enjoy a low, fixed rate with no surprises! Learn more > |

Common Credit Mistakes to Avoid

Pro Tip: Check your credit report for free once a year at AnnualCreditReport.com to spot errors and track your progress. |

|

|

Final ThoughtsYour credit score is like a financial report card—it takes time to build, but the effort pays off. By understanding how it works and making smart choices, you’ll set yourself up for success when it’s time to buy a car, rent an apartment, or even start a business. Start small, stay consistent, and watch your credit score grow!

|

Trivia Answer

What is an emergency fund?

B) Money set aside to cover unexpected expenses

As of January 2025, more than two in five Americans (42%) do not have an emergency savings fund. Additionally, 40% of Americans couldn't cover a $1,000 emergency expense with cash or savings. Source: US News & World Report.