Welcome to Rising Wealth, Rising Stars – your go-to newsletter for financial literacy tips, money-saving hacks, and campus resources designed to help you thrive both in and out of the classroom.

In this issue of Rising Wealth, Rising Stars we’re tackling credit scores—what they are, why they matter, and how to boost yours.

Understanding Your Credit Score: A Guide for College Students

As a college student, you might not think much about your credit score—but it plays a huge role in your financial future. Your credit score can determine whether you get approved for a car loan, an apartment, or even a credit card. Understanding how it works now can save you trouble later.

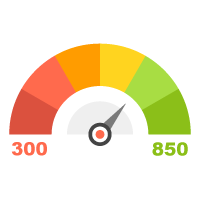

What is a Credit Score?A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. The most common credit scoring model is the FICO Score, which ranges from 300 to 850. The higher your score, the better your chances of getting approved for loans and securing lower interest rates.

|

|

|

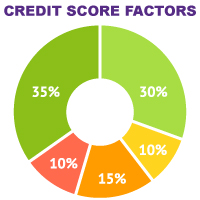

What Factors Affect Your Credit Score?Your credit score is determined by several key factors:

|

Why Does Your Credit Score Matter?Your credit score can impact your life in big ways. Let's break this down: Let’s say you're looking to buy a new car, and choose to finance it. If your credit score is on the higher side, 720 for example, you may qualify for a low-interest auto loan, saving you thousands of dollars over time. But if your score is on the lower end, 550 for example, you might get denied or stuck with a high-interest loan, making the car much more expensive.

|

|

|

|

How to Build Credit as a College StudentIf you’re just starting out, here are some easy ways to build your credit:

Pro Tip: Your credit score matters as much as your GPA. Start building it with the Student VISA Credit Card from CASE Credit Union, perfect for beginners. Plus, enjoy a low, fixed rate with no surprises! Learn more > |

Common Credit Mistakes to Avoid

Pro Tip: Check your credit report for free once a year at AnnualCreditReport.com to spot errors and track your progress. |

|

|

|

Final ThoughtsYour credit score is like a financial report card—it takes time to build, but the effort pays off. By understanding how it works and making smart choices, you’ll set yourself up for success when it’s time to buy a car, rent an apartment, or even start a business. Start small, stay consistent, and watch your credit score grow!

|