Enjoy rewards on every purchase!

How it works:

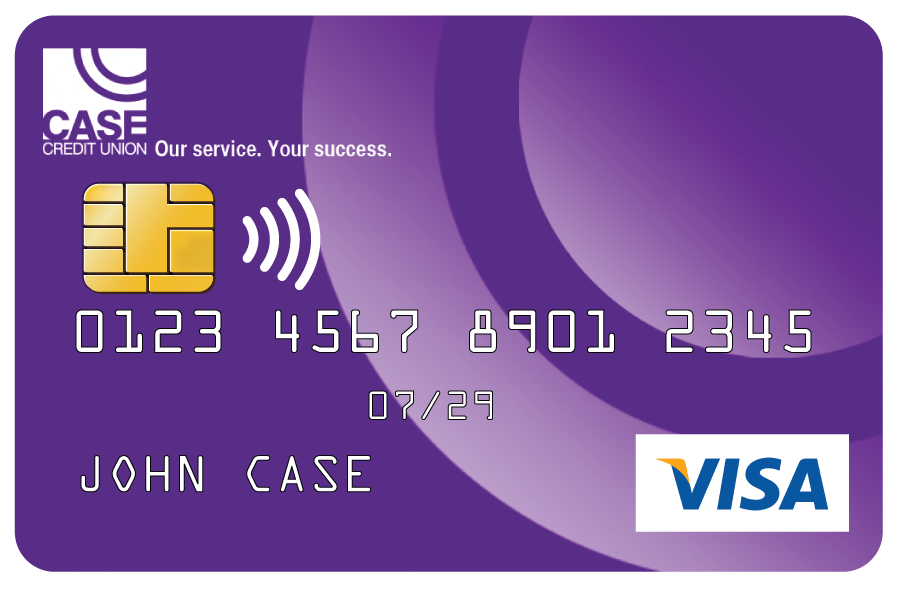

Debit Rewards Checking Account

|

Platinum uChoose Rewards VISA Credit Card

|

Business Premier VISA Credit Card

|

|---|---|---|

Earn Cash Back

|

Earn Cash Back

|

Earn Cash Back

|

Cash Back And Points:

uChoose Rewards Program Agreement: If you register your new debit or credit card with uChoose Rewards, your Rewards Program Agreement will be available to you while registering. For more information and for Terms and Conditions about the uChoose Reward Program, log in to your uChoose Reward Program account.

"Cash Back rewards" are the rewards you earn under the uChoose Rewards Program. Cash Back rewards are tracked as points and each $1 in Cash Back rewards earned is equal to 1 point for the Cash Back special categories on the Platinum uChoose Rewards VISA Credit Card, Business Premier VISA Credit Card, and the Debit Rewards Checking Account, with the exception of the Debit Reward Checking Account’s 0.33% all other purchases category, which are tracked as points and each $1 in Cash Back rewards earned is equal to 0.33 points. You may simply see "Cash Back" in marketing materials when referring to the rewards you earn. You may also see, "points" or "uChoose Rewards points" when referring to the points you can use. In order to redeem Cash Back rewards, a minimum of 1,500 points is required for all three account types.

How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a CASE Debit Card from a Debit Rewards Checking Account, CASE’s Platinum uChoose Rewards VISA Credit Card, or CASE’s Business Premier VISA Credit Card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count and won't earn points: balance transfers, cash advances, and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.

Cash Back Breakdown: Debit Rewards Checking Account³ 4% Cash Back rewards total for each $1 spent on purchases made in the grocery store category. 3% Cash Back rewards total for each $1 spent on purchases made in the gas station services category. 2% Cash Back rewards total for each $1 spent on utility purchases. 0.33% Cash Back rewards total for each $1 spent on purchases made on all other purchases.

Platinum uChoose Rewards VISA Credit Card and the Business Premier VISA Credit Card³ 4% Cash Back rewards total for each $1 spent on purchases made in the grocery store category. 3% Cash Back rewards total for each $1 spent on purchases made in the gas station services category. 2% Cash Back rewards total for each $1 spent on utility purchases. 1% Cash Back rewards total for each $1 spent on purchases made on all other purchases.

How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and much more. Redemption values for reward options vary.

Points expiration/losing points: Your points expire after five (5) years, however, you will immediately lose all your points if your account status changes or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the uChoose Rewards Program Agreement.

Rewards Categories: Merchants who accept VISA debit and credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with VISA procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you.

Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information on uChoose's reward categories, log in your uChoose Reward Program account.